Let's learn about Staking via these 76 free stories. They are ordered by most time reading created on HackerNoon. Visit the /Learn Repo to find the most read stories about any technology.

1. DAFI Protocol, the Chain Link of Staking Rewards

An interview with Zain Rana, the founder and CEO of DAFI Protocol that brings new innovations to Staking in cryptocurrencies and blockchain technologies

An interview with Zain Rana, the founder and CEO of DAFI Protocol that brings new innovations to Staking in cryptocurrencies and blockchain technologies

2. Web3 Service Provider Ankr Integrates Staking with its Infrastructure Layer

Ankr, a decentralised infrastructure platform announced the addition of token staking to its infrastructure layer, enabling Web3 users to profit from the fees.

Ankr, a decentralised infrastructure platform announced the addition of token staking to its infrastructure layer, enabling Web3 users to profit from the fees.

3. Node Providers

The node provider market is crowded. New players have few opportunities: support long tailed assets, better UX, lower price.

The node provider market is crowded. New players have few opportunities: support long tailed assets, better UX, lower price.

4. Generating Passive Income Through Filecoin Staking

In this post, we'll explore the concept of staking and how will you benefit from Filecoin staking.

In this post, we'll explore the concept of staking and how will you benefit from Filecoin staking.

5. Is Regulation Really Needed in the Crypto Space?

Despite all the talk of regulatory standards and bills, the questions of whether the cryptocurrency space really needs intervention has yet to be answered.

Despite all the talk of regulatory standards and bills, the questions of whether the cryptocurrency space really needs intervention has yet to be answered.

6. Introducing Compounding Rewards Feature For Dapp Staking

Astar is introducing its new compounding rewards features which will allow users to claim their staked rewards which will automatically be restaked.

Astar is introducing its new compounding rewards features which will allow users to claim their staked rewards which will automatically be restaked.

7. Coinbase Is About to Be Sued By the SEC

Coinbase Lawsuit Incoming!

Coinbase Lawsuit Incoming!

8. Independent Ethereum Staking in 2022 and How to Tie Validators to Beacon Nodes

Independent staking is the gold standard of Ethereum staking. So today we investigate how to do it in 2way, simplifying validator and beacon nodes

Independent staking is the gold standard of Ethereum staking. So today we investigate how to do it in 2way, simplifying validator and beacon nodes

9. Staking Vs Liquidity Mining Vs Yield Farming – An Unbiased Comparison

Staking vs Liquidity mining vs Yield Farming are good methods to put your crypto assets in the protocol and facilitate trading, lending and borrowing.

Staking vs Liquidity mining vs Yield Farming are good methods to put your crypto assets in the protocol and facilitate trading, lending and borrowing.

10. How Can You Earn Interest with Cryptocurrency?

In many ways, cryptocurrency is starting to replace the ways people increase their wealth, earn interest, and even earn a passive income!

In many ways, cryptocurrency is starting to replace the ways people increase their wealth, earn interest, and even earn a passive income!

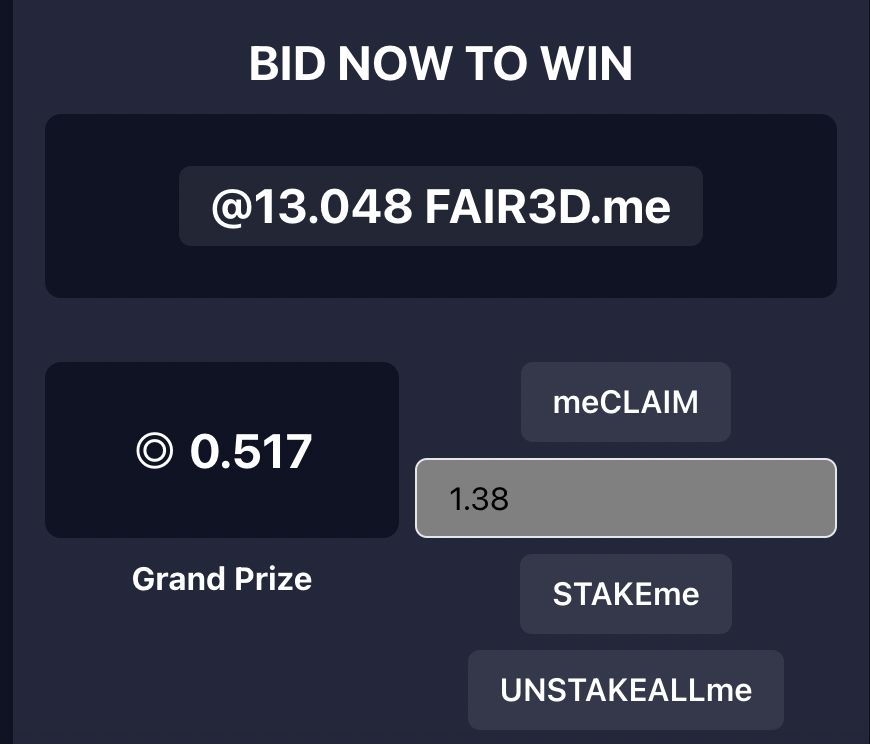

11. Fomo3d on Solana: Making my Own Blockchain Game Factory

This article is more of a how-to guide on the various ways one can play the current evolution of my blockchain game fair3d.me

This article is more of a how-to guide on the various ways one can play the current evolution of my blockchain game fair3d.me

12. Can Uniswap Be Left Behind?

With newly-launched DEXs, Uniswap V3 is running late. That’s the project that carved out a niche one day and conquered the crypto market. Let’s face the music - even titans can lose over time. The next-gen platform that looks ahead of the pack is Algebra.Finance.

With newly-launched DEXs, Uniswap V3 is running late. That’s the project that carved out a niche one day and conquered the crypto market. Let’s face the music - even titans can lose over time. The next-gen platform that looks ahead of the pack is Algebra.Finance.

13. OSWAP Token: Incentivizing Liquidity Provision in Oswap Pools

OSWAP token reflects the success of the Oswap protocol and rewards the liquidity providers. It automatically appreciates at a rate that depends on Oswap TVL.

OSWAP token reflects the success of the Oswap protocol and rewards the liquidity providers. It automatically appreciates at a rate that depends on Oswap TVL.

14. Staking NFTs – A Beating Heart Among Stillness or Clinically Dead?

The genuine features of NFTs make them ideal for wait-and-HODL strategies but has the era of staking NFTs come to its end? Some don't think so.

The genuine features of NFTs make them ideal for wait-and-HODL strategies but has the era of staking NFTs come to its end? Some don't think so.

15. Ethereum Shanghai Upgrade Set to Unlock Staked Ether and Boost Staking Ratios

The widely anticipated Ethereum Shanghai upgrade is scheduled for early April 2023. The upgrade will unlock staked Ether that, for some, was inaccessible since December 2020. The results of the upgrade will have direct implications on Ether’s price, staking ratios, liquid staking and Proof of Stake community, and the industry as a whole.

The widely anticipated Ethereum Shanghai upgrade is scheduled for early April 2023. The upgrade will unlock staked Ether that, for some, was inaccessible since December 2020. The results of the upgrade will have direct implications on Ether’s price, staking ratios, liquid staking and Proof of Stake community, and the industry as a whole.

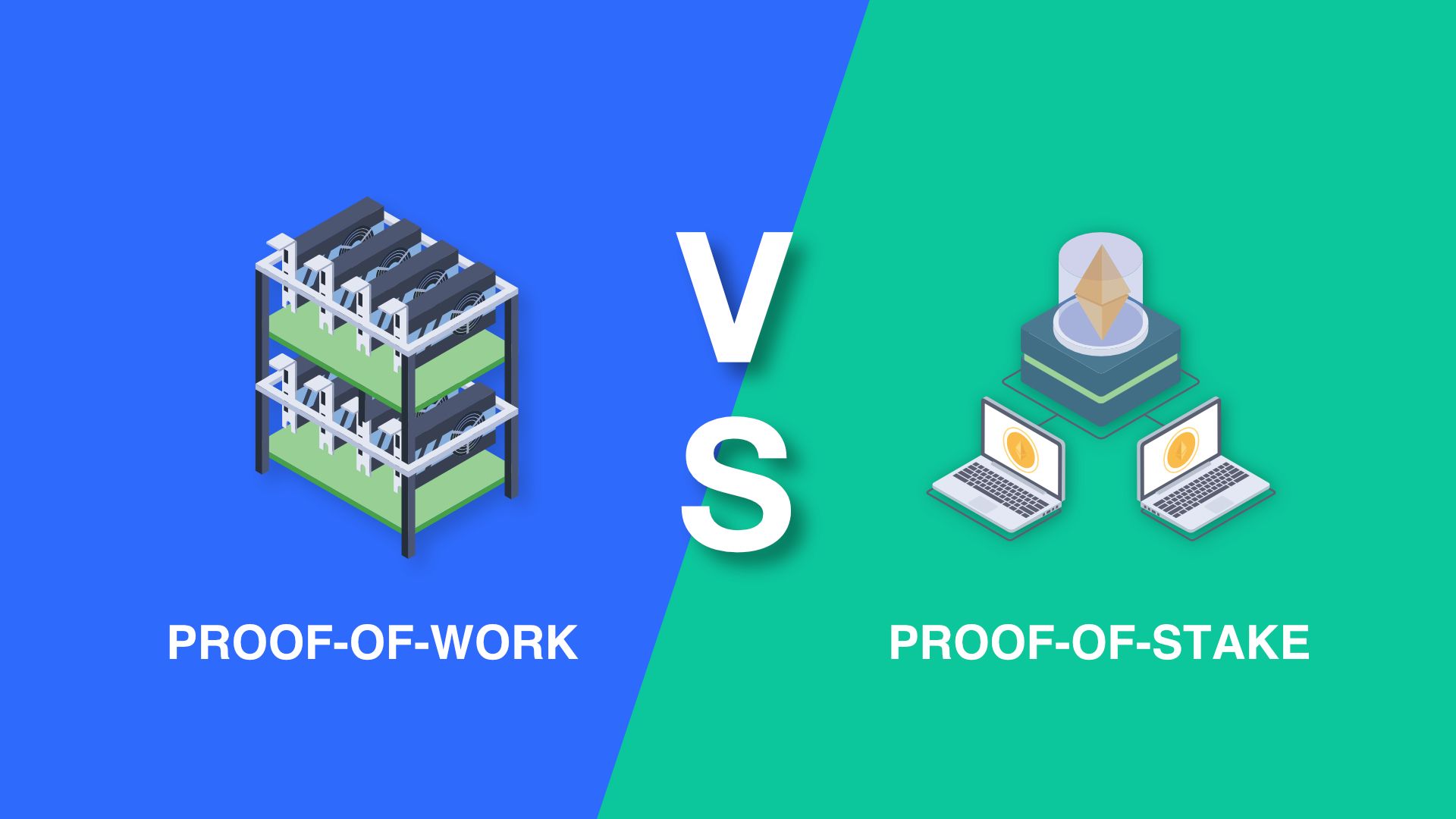

16. Coming to Consensus: Proof-of-Work vs Proof-of-Stake

An article that both explains and compares Proof-of-Work (used by Bitcoin and Ethereum) and Proof-of-Stake (used by many other blockchains)

An article that both explains and compares Proof-of-Work (used by Bitcoin and Ethereum) and Proof-of-Stake (used by many other blockchains)

17. How To Stake On The Top Layer 1s?

Learn how to stake on the two blockchain protocols that call themselves the 'World Computers' -- Ethereum and the Internet Computer in a post-merge world.

Learn how to stake on the two blockchain protocols that call themselves the 'World Computers' -- Ethereum and the Internet Computer in a post-merge world.

18. The Ultimate Guide to Crypto Staking

Crypto staking is taking world finance to a new level. When more people come on board to DeFi, it will start a Web3 revolution.

Crypto staking is taking world finance to a new level. When more people come on board to DeFi, it will start a Web3 revolution.

19. Introducing StakeBoard: a Beginner-Friendly Web3 Staking Dashboard

StakeBoard provides a single dashboard that allows stakers to track their staking accounts in a single app.

StakeBoard provides a single dashboard that allows stakers to track their staking accounts in a single app.

20. [Announcement] Digitex Is Building A City, A Stablecoin, And A Staking Program For You

Even before launch at the end of July, we'd already built a loyal and engaged community. Over the time it took to develop our zero-fee futures exchange, we reached a lot of people--and we've been learning from their feedback.

Even before launch at the end of July, we'd already built a loyal and engaged community. Over the time it took to develop our zero-fee futures exchange, we reached a lot of people--and we've been learning from their feedback.

21. How Telecommunication Companies can Impact Defi and Staking

In the presentation below, the Product Owner at T-Systems shares details about how the telecommunications company is providing blockchain infrastructure.

In the presentation below, the Product Owner at T-Systems shares details about how the telecommunications company is providing blockchain infrastructure.

22. How Polygon Supernets and Ankr Help Build Modular Blockchain Apps

Polygon Supernets is an EVM-compatible modular blockchain stack that enables developers to have a custom decentralized modular network.

Polygon Supernets is an EVM-compatible modular blockchain stack that enables developers to have a custom decentralized modular network.

23. Cryptocurrencies Should Serve The Real People, Not The Privileged Few

MEME TAO is a DeFi-based hedge fund that empowers proven crypto investors to manage a set of pre-targeted crypto funds.

MEME TAO is a DeFi-based hedge fund that empowers proven crypto investors to manage a set of pre-targeted crypto funds.

24. Bridging CeFi and DeFi: Better Risk Management and More Sustainable Wealth Generation

Have you ever staked tokens on a large crypto exchange like Binance or Coinbase?

Have you ever staked tokens on a large crypto exchange like Binance or Coinbase?

25. Is Yield Farming Still Viable in 2022?

Let's look at yield farming, how it works and if it's still worthwhile for users in the Defi space during the current market conditions after the crash.

Let's look at yield farming, how it works and if it's still worthwhile for users in the Defi space during the current market conditions after the crash.

26. WTF is Exchange Staking?

Introduction

Introduction

27. Rules You Need to Know Before Staking

Staking is like the treasury of the crypto world. It offers low-risk yield and is the best strategy in the bear market. Here are must know rules before staking.

Staking is like the treasury of the crypto world. It offers low-risk yield and is the best strategy in the bear market. Here are must know rules before staking.

28. Solo Staking on Ethereum and Earning Rewards Using Infura After The Merge

How to solo stake on Ethereum after The Merge, considerations and things to be aware of leading up to The Merge, and how to stay up to date. Read it all here.

How to solo stake on Ethereum after The Merge, considerations and things to be aware of leading up to The Merge, and how to stay up to date. Read it all here.

29. We're Making Your Crypto-Investments Smarter - Here's How

Throughout the short recent history of the cryptocurrency revolution, everyone from the most dedicated technology evangelists to large institutional investors have been looking for ways to harness the stunning wealth-generation powers of this new financial instrument.

Throughout the short recent history of the cryptocurrency revolution, everyone from the most dedicated technology evangelists to large institutional investors have been looking for ways to harness the stunning wealth-generation powers of this new financial instrument.

30. DeFi Lacked Cohesion and Automation - Until Now

DeFi is finally providing viable use cases for cryptocurrencies beyond being a speculative value storage.

DeFi is finally providing viable use cases for cryptocurrencies beyond being a speculative value storage.

31. Everything Wrong with Proof of Stake

Staking is another form of centralized control.

Staking is another form of centralized control.

32. Cake DeFi has Given Out $317 Million in Rewards as of Q1 2022

CakeDeFi has paid around $317 million in rewards to its customers as of the end of Q1 2022 to become one of the fastest growing DeFi platforms in Asia.

CakeDeFi has paid around $317 million in rewards to its customers as of the end of Q1 2022 to become one of the fastest growing DeFi platforms in Asia.

33. Why Startups aren't Using Ethereum

This interview talks about the rising ethereum transaction fees, cross-fi staking and cybersecurity for blockchain startups.

This interview talks about the rising ethereum transaction fees, cross-fi staking and cybersecurity for blockchain startups.

34. A Guide on Staking the Axie Infinity Sidechain

This is a complete guide for those who play Axie infinity and know it well BUT also for complete beginners with no previous knowledge of staking and Axie Tokens

This is a complete guide for those who play Axie infinity and know it well BUT also for complete beginners with no previous knowledge of staking and Axie Tokens

35. Staking, Yield Farming, Lending: DeFi Remains Crypto's Home for Passive Income

DeFi has made access to financial services easier and with its farms, lending services and staking rewards, the ecosystem is a go-to for profit-hungry investors

DeFi has made access to financial services easier and with its farms, lending services and staking rewards, the ecosystem is a go-to for profit-hungry investors

36. How To Get Started On Staking

Staking is a way to make money from your idle Proof-of-Stake (PoS) cryptocurrency without trading while getting genuinely involved with its network.

Staking is a way to make money from your idle Proof-of-Stake (PoS) cryptocurrency without trading while getting genuinely involved with its network.

37. Why Liquid Staking Benefits the Crypto Ecosystem

Proof of Stake (PoS) blockchains are waiting for you to stake your crypto. Yet staking’s low participation — only 24% of the total market cap of staking platforms are locked in staking — means that crypto enthusiasts have yet to realize its benefits.

Proof of Stake (PoS) blockchains are waiting for you to stake your crypto. Yet staking’s low participation — only 24% of the total market cap of staking platforms are locked in staking — means that crypto enthusiasts have yet to realize its benefits.

38. Blockchain Newsletter: Liquid Staking Protocol & Finance Derivatives & Future

The ecosystem of staking is established. Big players have already gained a strong position in the market. The total staking market will continue to grow.

The ecosystem of staking is established. Big players have already gained a strong position in the market. The total staking market will continue to grow.

39. Understanding Staking and Generating Passive Income in the World of Cryptocurrency

The recent trend of the cryptocurrency market seems to be on a replay: the prices of cryptocurrencies go up in a minute and in another hour, declines faster than it rose. In recent times, individuals have made digital currencies, an alternative or additional source of income.

The recent trend of the cryptocurrency market seems to be on a replay: the prices of cryptocurrencies go up in a minute and in another hour, declines faster than it rose. In recent times, individuals have made digital currencies, an alternative or additional source of income.

40. More Than Just HODLing: Under Discussed Aspects of PoS

The benefits to staking are well-documented, but the risks of not staking are less talked about.

The benefits to staking are well-documented, but the risks of not staking are less talked about.

41. The Evolving Landscape of Prediction Markets

An examination of how the cryptocurrency industry is revolutionizing the prediction market space.

An examination of how the cryptocurrency industry is revolutionizing the prediction market space.

42. How Ethereum Staking is Creating a $10 Billion Ponzi Scheme

One of the Ponzi scheme in the history, no one is sounding the alarm!

One of the Ponzi scheme in the history, no one is sounding the alarm!

43. Staking Tokens on the Bancor Network: A Step by Step Guide

“Staking liquidity essentially gives token holders a passive income, while bolstering the overall health of the decentralized network.” -Cryptoslate

“Staking liquidity essentially gives token holders a passive income, while bolstering the overall health of the decentralized network.” -Cryptoslate

44. [Announcement] Mega Rewards on Digitex Program Coming Soon With Uniswap

DeFi has dominated the topic of conversation in the cryptocurrency space in 2020 with few signs of slowing down. Among its many innovations, the trend of liquidity mining has without doubt caused the largest stir and allowed investors to make massive gains reminiscent of the ICO days.

DeFi has dominated the topic of conversation in the cryptocurrency space in 2020 with few signs of slowing down. Among its many innovations, the trend of liquidity mining has without doubt caused the largest stir and allowed investors to make massive gains reminiscent of the ICO days.

45. DeFi’s Rise to Shame: Its Problems and How to Fix Them

With the emergence of Bitcoin, a lot of financial experts predicted big changes due to the utilization of cryptocurrencies.

With the emergence of Bitcoin, a lot of financial experts predicted big changes due to the utilization of cryptocurrencies.

46. What if You Could Post on FB and Get Paid For it in Crypto?

It’s not difficult to imagine what Facebook might look like today if a cryptocurrency had been embedded in the business plan from the beginning.

It’s not difficult to imagine what Facebook might look like today if a cryptocurrency had been embedded in the business plan from the beginning.

47. Proof of Stake (PoS): Staking as a Tool For The Passive Income

Proof of Stake (PoS): Pros and Cons of Staking as a Tool For The Passive Income

Proof of Stake (PoS): Pros and Cons of Staking as a Tool For The Passive Income

48. How to Easily Create an NFT Collection with Staking in 10 minutes

Create a new NFT collection, with custom Minting page, and Staking under 10 minutes.

Create a new NFT collection, with custom Minting page, and Staking under 10 minutes.

49. Saving Your Money in a Crisis With Cryptocurrencies

In DeFi, the yield on deposits in dollar stablecoins reaches 15-20%. I discuss the risks and where to invest for a conservated crypto-investor in 2022.

In DeFi, the yield on deposits in dollar stablecoins reaches 15-20%. I discuss the risks and where to invest for a conservated crypto-investor in 2022.

50. A Look at XDC Network & Delegated Proof-of-Stake in 2022

A Look at Delegated Proof-of-Stake in 2022

A Look at Delegated Proof-of-Stake in 2022

51. Crypto Staking: Assessing the Risks and Profitability of USD Neutrino, Cosmos and others

Crypto industry keeps generating new investment tools – only to be discarded in disappointment a year or two later. The latest trend is staking - delegating coins to to earn validation rewards on the blockchain. Is it a legitimate passive income scheme? And what should you choose - regular PoS coins like Cosmos or stakable stablecoins?

Crypto industry keeps generating new investment tools – only to be discarded in disappointment a year or two later. The latest trend is staking - delegating coins to to earn validation rewards on the blockchain. Is it a legitimate passive income scheme? And what should you choose - regular PoS coins like Cosmos or stakable stablecoins?

52. HotStuff: The Consensus Protocol Behind SafeStake and Facebook's LibraBFT

With HotStuff, SafeStake governs the operator networks to determine the message content of the threshold signature scheme among the operator nodes.

With HotStuff, SafeStake governs the operator networks to determine the message content of the threshold signature scheme among the operator nodes.

53. From 0 to 1000 Nodes on a Testnet: Case Study on Avalanche Denali

What is a testnet?

What is a testnet?

54. Earning passive income from cryptocurrency in 2020: Market Review

While the lending market craze is plummeting and the “yield farming” opportunities are not as profitable as they were in the beginning, you might be looking for new ways to put your money at work.

While the lending market craze is plummeting and the “yield farming” opportunities are not as profitable as they were in the beginning, you might be looking for new ways to put your money at work.

55. Digital Assets: Are We Still Early?

Over the past few weeks if you're in the digital asset space you've probably received texts or questions over the holidays on what to buy or if it's a good time to do so etc. etc. I'm writing this in an effort to give my opinion which is in no way shape or form financial advice.

Over the past few weeks if you're in the digital asset space you've probably received texts or questions over the holidays on what to buy or if it's a good time to do so etc. etc. I'm writing this in an effort to give my opinion which is in no way shape or form financial advice.

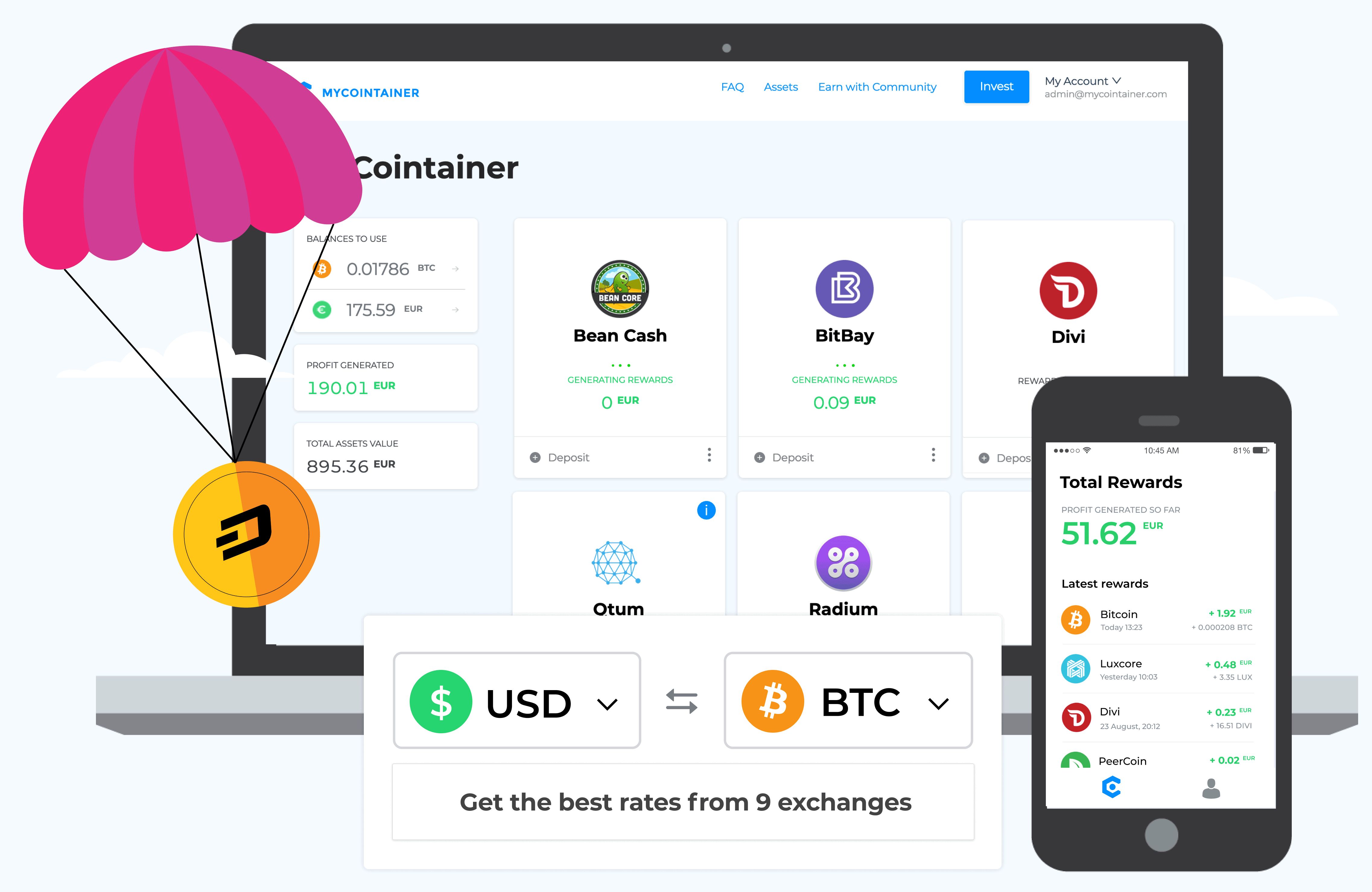

56. How Does An Automated Staking Ecosystem: A MyCointainer Review

A similar staking mechanism whereby you can run an automated staking and masternode operation and receive profits in return.

A similar staking mechanism whereby you can run an automated staking and masternode operation and receive profits in return.

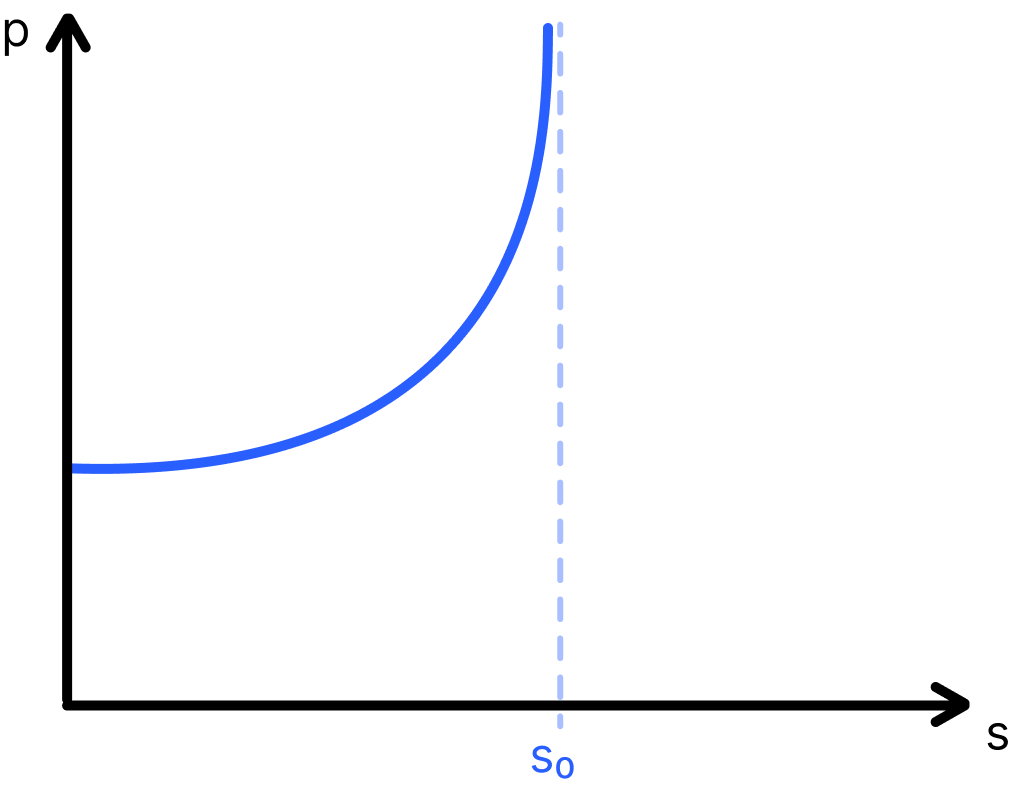

57. Tokenized Locking in an Algorithmic Backed Protocol

When compared to other options, the idea of locking funds in any way costs the user, but it benefits both the user and the system in terms of stability.

When compared to other options, the idea of locking funds in any way costs the user, but it benefits both the user and the system in terms of stability.

58. Ethereum 2.0: An Overview

Ethereum 2.0 will bring about a lot of changes to the Ethereum network. The main purpose of the upgrade is to make the blockchain FASTER (>15tx/sec), and more SECURE (51% attacks, centralization), while also saving energy (as opposed to mining with electricity). But this update will also imply a host of other changes, such as economic changes, which can also be seen as a way of responding to Ethereum’s stubborn critics, who keep pointing out its crucial issues, such as scalability (remember Cryptokitties?) and fees. Ethereum 2.0 shall lead the way for Ethereum to advance both its technological and economic structure in an attempt to better master the challenges of Blockchain in 2020 and beyond, as well as create new opportunities. However, the most important thing to note here is, that Ethereum 2.0 eventually aims to convert the ETH blockchain from Proof of Work to a PROOF OF STAKE mechanism, and introducing shard chains.

Ethereum 2.0 will bring about a lot of changes to the Ethereum network. The main purpose of the upgrade is to make the blockchain FASTER (>15tx/sec), and more SECURE (51% attacks, centralization), while also saving energy (as opposed to mining with electricity). But this update will also imply a host of other changes, such as economic changes, which can also be seen as a way of responding to Ethereum’s stubborn critics, who keep pointing out its crucial issues, such as scalability (remember Cryptokitties?) and fees. Ethereum 2.0 shall lead the way for Ethereum to advance both its technological and economic structure in an attempt to better master the challenges of Blockchain in 2020 and beyond, as well as create new opportunities. However, the most important thing to note here is, that Ethereum 2.0 eventually aims to convert the ETH blockchain from Proof of Work to a PROOF OF STAKE mechanism, and introducing shard chains.

59. Ethereum 2.0 staking on AWS: Cloud Staking Matters

Learn how to stake Ethereum 2.0 independently with non-custodial Launchnodes. We dive into Ethereum staking on AWS and benefits of having no intermediaries.

Learn how to stake Ethereum 2.0 independently with non-custodial Launchnodes. We dive into Ethereum staking on AWS and benefits of having no intermediaries.

60. How To Build A Secure Eth2 Staking Infrastructure

Ethereum 1.0 was a landmark moment in blockchain technology. Allowing for the trustless execution of code on a blockchain in its current form, however, it does not have the ability to scale to the level of computation that would be needed to disrupt current financial systems.

Ethereum 1.0 was a landmark moment in blockchain technology. Allowing for the trustless execution of code on a blockchain in its current form, however, it does not have the ability to scale to the level of computation that would be needed to disrupt current financial systems.

61. Here’s What's Coming Next for PrivacySwap 2.0

PrivacySwap 2.0 is now complete. Now that we are creating our DEX, here’s what we offer and our plans for our next migration

PrivacySwap 2.0 is now complete. Now that we are creating our DEX, here’s what we offer and our plans for our next migration

62. The Cardano Blockchain Review

Like many other projects in the early days, Cardano was funded through a US $62.2 million initial coin offering.

Like many other projects in the early days, Cardano was funded through a US $62.2 million initial coin offering.

63. Exploring Passive Income in Cryptocurrencies: Will 2020 be Year of Staking?

The blockchain industry definitely looks like a blue ocean - there are a lot of opportunities, the wind changes fast, and the calm suddenly can be replaced by the storm. And, as in real sailing, to be successful it means to catch a wave and tailwind.

The blockchain industry definitely looks like a blue ocean - there are a lot of opportunities, the wind changes fast, and the calm suddenly can be replaced by the storm. And, as in real sailing, to be successful it means to catch a wave and tailwind.

64. The Double-Edged Sword of Masternodes: What Happens When Inflation Surpasses Reward

The Dash cryptocurrency network invented the masternode concept in 2014, and has recently come to an interesting conclusion: that masternodes heavily influence the coin’s market cap — both for better and for worse.

The Dash cryptocurrency network invented the masternode concept in 2014, and has recently come to an interesting conclusion: that masternodes heavily influence the coin’s market cap — both for better and for worse.

65. DAFI Protocol's Collaboration With Polygen Allows New Projects to Use Staking 2.0

DAFI announced a partnership with Polygen to enable new decentralized applications launching on the permissionless launchpad to integrate Staking 2.0.

DAFI announced a partnership with Polygen to enable new decentralized applications launching on the permissionless launchpad to integrate Staking 2.0.

66. Liquid Staking Options: Unlock the Potential of Your Digital Assets

Cryptocurrencies offer a unique opportunity to monetize assets through Liquid Staking regardless of their nature, from NFTs to synthetic Forex derivatives.

Cryptocurrencies offer a unique opportunity to monetize assets through Liquid Staking regardless of their nature, from NFTs to synthetic Forex derivatives.

67. How To Grow Your DeFi Staking Portfolio Safely

One of the main drivers of Decentralized Finance (DeFi) is that it can turn anyone with internet access into a virtual bank. And we all know how banks make their money — through interest rates set for borrowing and lending. On a DeFi protocol, from Uniswap and Aave to Compound, users become banks the moment they lock their funds into liquidity pools.

One of the main drivers of Decentralized Finance (DeFi) is that it can turn anyone with internet access into a virtual bank. And we all know how banks make their money — through interest rates set for borrowing and lending. On a DeFi protocol, from Uniswap and Aave to Compound, users become banks the moment they lock their funds into liquidity pools.

68. DeFi Projects That Offer Top Staking Rewards in 2021

When it comes to determining the best staking rewards, a lot comes down to your strategy. DeFi is diverse, and you can earn profits in many different ways.

When it comes to determining the best staking rewards, a lot comes down to your strategy. DeFi is diverse, and you can earn profits in many different ways.

69. What is Supernode Proof of Stake and Can it Replace Proof of Stake?

One of the most important aspects of any blockchain network is the consensus algorithm that is used to validate transactions. In centralized systems like Visa and MasterCard, transactions are verified by a host of authorities. On the other hand, in a decentralized system like blockchain, the network nodes need a set of rules to help them arrive at consensus

regarding the authenticity of new transactions. This is where the consensus algorithm comes in.

One of the most important aspects of any blockchain network is the consensus algorithm that is used to validate transactions. In centralized systems like Visa and MasterCard, transactions are verified by a host of authorities. On the other hand, in a decentralized system like blockchain, the network nodes need a set of rules to help them arrive at consensus

regarding the authenticity of new transactions. This is where the consensus algorithm comes in.

70. "The Need for Interoperability Is Becoming Increasingly Clear" - Jack Lu

This article talks about blockchain interoperability and the early days of ethereum and smart contract development.

This article talks about blockchain interoperability and the early days of ethereum and smart contract development.

71. Crypto Staking in 2020: An Overview

Public blockchains involve active participants (miners, validators, node operators etc.) to contribute towards the common goal of strengthening the network and confirming transactions through some sort of distributed consensus algorithm.

Public blockchains involve active participants (miners, validators, node operators etc.) to contribute towards the common goal of strengthening the network and confirming transactions through some sort of distributed consensus algorithm.

72. Can You Earn Crypto by Mining/Staking If You Are Not a Programmer?

However, anyone can start investing and making a profit. In the long term, you can make cryptocurrency, which has been proven in practice.

However, anyone can start investing and making a profit. In the long term, you can make cryptocurrency, which has been proven in practice.

73. Earning Passive Income with DeFi Staking: An Overview

DeFi staking is one of the hottest trends in the cryptocurrency industry today. It is a simple yet powerful concept that leverages the benefits of decentralized finance. Moreover, staking is still considered one of the best ways to generate passive income from one's existing crypto holdings.

DeFi staking is one of the hottest trends in the cryptocurrency industry today. It is a simple yet powerful concept that leverages the benefits of decentralized finance. Moreover, staking is still considered one of the best ways to generate passive income from one's existing crypto holdings.

74. Everything You Ever Wanted To Know About Cryptocurrency Staking

Everyone and his grandma know what cryptocurrency mining is. Well, they may not indeed know what it actually is, in technical terms, but they have definitely heard the phrase as it is hard to miss the news about mining sucking in energy like a black hole gobbles up matter. On the other hand, staking, its little bro, has mostly been hiding in the shadows until recently.

Everyone and his grandma know what cryptocurrency mining is. Well, they may not indeed know what it actually is, in technical terms, but they have definitely heard the phrase as it is hard to miss the news about mining sucking in energy like a black hole gobbles up matter. On the other hand, staking, its little bro, has mostly been hiding in the shadows until recently.

Today, with DeFi making breaking news across the cryptoverse, staking has become a new buzzword in the blockchain space and beyond, along with the fresh entries to the crypto asset investor’s vocabulary such as “yield farming”, “rug pull”, “total value locked”, and similar arcane stuff. If you are not scared off yet, then read on. Though we can’t promise you won’t be.

75. What Would Staking Look Like On Ethereum 2.0?

Proof-of-work (PoW) and proof-of-stake (PoS) are the two most widely employed blockchain protocols. Blockchain proponents often indulge in debates to prove which of the two is actually better, never really reaching a consensus (pun intended).

Proof-of-work (PoW) and proof-of-stake (PoS) are the two most widely employed blockchain protocols. Blockchain proponents often indulge in debates to prove which of the two is actually better, never really reaching a consensus (pun intended).

76. DeFi - Scratching The Surface To See What Lies Underneath

The DeFi frenzy has got the crypto world in its grip. Recently listed DeFi projects, such as MantraDAO, DeFiPie and PlutusDeFi, have generated a significant amount of interest. Simultaneously, existing DeFi platforms like Uniswap, Compound and Aave, have seen a tremendous increase in usage.

The DeFi frenzy has got the crypto world in its grip. Recently listed DeFi projects, such as MantraDAO, DeFiPie and PlutusDeFi, have generated a significant amount of interest. Simultaneously, existing DeFi platforms like Uniswap, Compound and Aave, have seen a tremendous increase in usage.

And it’s not just an increase in use cases that has fueled this DeFi frenzy; there’s enough theatrical in the world of DeFi to keep the crypto enthusiasts glued to their seats.

Thank you for checking out the 76 most read stories about Staking on HackerNoon.

Visit the /Learn Repo to find the most read stories about any technology.